The Employees’ Provident Fund Organization (EPFO) has launched a game-changing initiative—UPI-based claim settlement—allowing subscribers to withdraw their Provident Fund (PF) in minutes. This new digital feature simplifies the process, eliminating paperwork, lengthy wait times, and traditional banking hurdles.

With over 7.4 crore active EPF members in India, this move aims to make financial access more efficient and seamless. Whether you’re an employee looking for quick PF withdrawals or an employer guiding your workforce, this update is set to benefit millions.

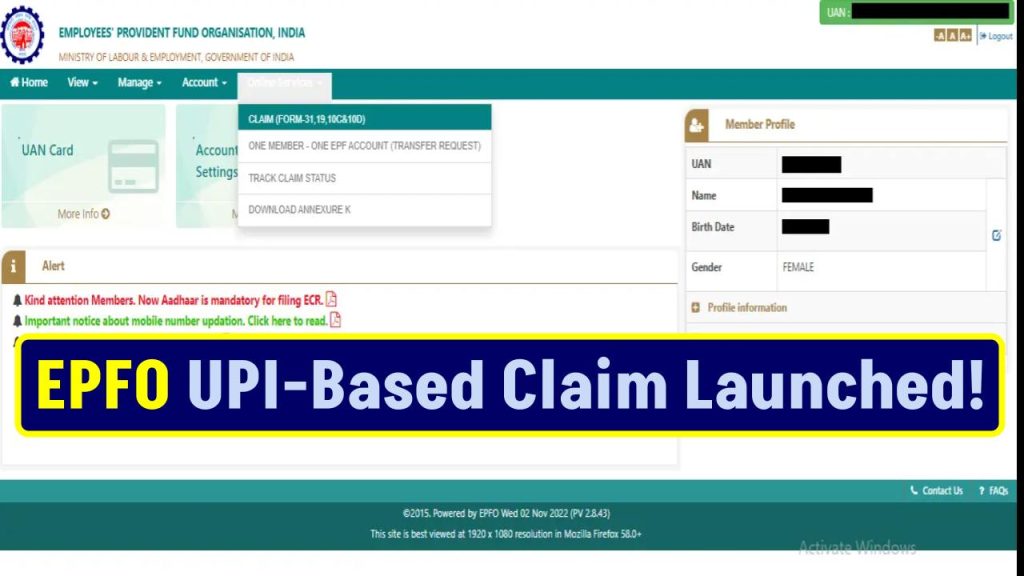

EPFO UPI-Based Claim Launched

| Feature | Details |

|---|---|

| Launch | Expected rollout in 2-3 months (2025) |

| Purpose | Faster, hassle-free PF withdrawals via UPI |

| Who Benefits? | 7.4 crore EPFO subscribers |

| Current PF Claims Data | ₹2.05 lakh crore disbursed in FY25 |

| Processing Time | Minutes instead of weeks |

| How to Access? | Link your UPI ID to EPFO |

| EPFO Official Website | epfindia.gov.in |

The EPFO UPI-based PF withdrawal feature is a game-changer, making fund withdrawals faster, easier, and paperless. This move aligns with India’s digital payments revolution, improving financial accessibility for millions of employees.

Whether you’re withdrawing PF for an emergency, retirement, or job change, this feature ensures instant, hassle-free access to your hard-earned money.

Want to Try This Out?

Visit the official EPFO Portal and link your UPI ID today!

Also Check: New California Driving Laws 2025: Parking Rules, Anti-Sideshow Crackdowns & More – What You Need to Know!

What is EPFO UPI-Based Claim Launched?

The EPFO UPI-based claim feature is an upgrade to the traditional PF withdrawal process. Instead of bank account verification delays, users can now withdraw their Provident Fund (PF) directly via UPI. This means:

- No need to visit the bank

- No dependency on IFSC codes or bank delays

- Faster claim approvals & real-time settlement

Why is This a Game-Changer?

Previously, PF claims took 5-20 days due to banking formalities like KYC checks, bank verifications, and NEFT processing delays. With UPI integration, funds are transferred instantly, removing middlemen and reducing fraud risks.

How Does EPFO UPI-Based Claim Launched?

The EPFO’s integration with UPI simplifies the entire claim settlement process. Here’s how it works:

Link Your UPI ID to EPFO

To use this feature, you must have a UPI-linked bank account. Popular UPI apps like Google Pay, PhonePe, Paytm, and BHIM are all supported.

Steps to Link UPI with EPFO:

- Log in to EPFO Member Portal (epfindia.gov.in)

- Go to KYC Section → Select “Add UPI ID”

- Enter Your UPI ID (Linked to your bank)

- Submit for Verification (Takes 24-48 hours)

- Once Approved, You Can Withdraw Instantly

Initiate a PF Withdrawal Request

Once your UPI ID is linked, follow these steps to withdraw:

- Visit EPFO Unified Portal

- Login using your UAN (Universal Account Number) & Password

- Click on “Online Services” > “Claim (Form-31, 19, 10C & 10D)”

- Select “Withdrawal Type” (Full/Partial)

- Choose UPI Payment Option

- Enter Your UPI ID & Submit

Claim approval happens instantly, and funds are credited within minutes.

Also Check: Big Change: Income Tax Bill 2025 to Tax Farming & Dairy Earnings!

EPFO UPI-Based Claim Launched: Advantages of EPFO’s UPI Integration

This initiative is not just about speed—it enhances financial inclusion, security, and user experience.

Faster & Hassle-Free Withdrawals

- Old Process: 5-20 days (NEFT-based)

- New UPI Process: Minutes to Hours

No Bank Account Verification Delays

- Previously, incorrect IFSC codes, frozen accounts, or bank issues delayed payments.

- With UPI, payments are processed directly via your linked ID.

More Secure & Fraud-Resistant

- UPI transactions are end-to-end encrypted, reducing fraud risks.

- Eliminates dependency on third-party banks or intermediaries.

Greater Accessibility

- Beneficial for rural workers who lack physical bank branches.

- Supports all UPI-enabled bank accounts.

EPFO UPI-Based Claim Launched Data & Trends

EPFO has processed over 50 million claims in FY25, disbursing ₹2.05 lakh crore—its highest ever. With UPI, this number is expected to grow significantly.

| Year | PF Claims Processed | Amount Disbursed |

|---|---|---|

| FY23 | 45 million | ₹1.8 lakh crore |

| FY24 | 48 million | ₹1.95 lakh crore |

| FY25 (Till Now) | 50 million+ | ₹2.05 lakh crore |

Source: Financial Express

Also Check: Deloitte Internship 2025: Dream Job in Data Analytics – Apply Before It’s Too Late!

EPFO UPI-Based Claim Launched (FAQs)

Can I Withdraw PF Without a Bank Account?

Yes! You can withdraw PF directly to your UPI ID, eliminating the need for a traditional bank account.

Which UPI Apps Are Supported?

All UPI-enabled apps like Google Pay, PhonePe, BHIM, Paytm, Amazon Pay, and WhatsApp Pay are supported.

What Happens If My UPI ID is Wrong?

Your claim will be rejected. Make sure to link a correct, active UPI ID.

Is There a Limit on PF Withdrawals via UPI?

Currently, EPFO has not announced a cap, but UPI has a daily transaction limit of ₹1 lakh per user.

How Long Does It Take to Approve My UPI KYC?

It takes 24-48 hours for EPFO to verify and approve your UPI details.